Why, How, and When to Issue Charitable Donation Receipts

Is your nonprofit organization looking to start accepting charitable donations? With the state of the world right now, many organizations are relying on donor support to continue delivering on their mission.

If that’s you, getting started isn’t difficult. You can set up a donation website and start fundraising. However, before you do, one crucial aspect to take into consideration is charitable donation receipts.

Having worked at several nonprofits in the past, I can say with certainty that donors take their donation receipts very seriously… and your organization should too.

Sending them too late — or worse yet, not sending them at all — can result in some very dissatisfied donors who likely won’t be donating to your organization again.

So, what exactly are donation receipts and why are they so important?

Read on to find out everything you need to know about why, how and when to issue donation receipts.

What is a Donation Receipt?

A donation receipt is a written acknowledgement that a donation has been made. While most receipts are created for this specific purpose, technically speaking, a letter, card or an email can also be considered a receipt, as long as it states the names of the organization and the donor, the date, and the amount of the donation.

Donation receipts have great benefits for both donors and the organization that issues them, but they’re most commonly used by donors when filing their taxes, as certain charitable donations can help reduce income taxes.

We’ll cover this more in depth later on, but before we do, it’s important to note that not all nonprofit organizations are qualified to accept tax deductible donations. Charitable donations made to 501(c)(3) organizations are tax deductible; however, donations made to other types of nonprofits, such as clubs, chambers of commerce, and homeowners’ associations, are not.

So, for the purposes of this blog post, we’ll define a donation receipt as a written acknowledgement of a charitable contribution made to a qualified 501(c)(3) nonprofit organization.

Why are Donation Receipts Necessary?

Perhaps the most important reason why donation receipts are issued is that donors can use their charitable contributions in any given year to reduce their income tax levels. Thus, they need to provide the IRS with proof that a donation has been made.

That being said, it’s good practice to provide a receipt even for small one-off donations that won’t be used for tax purposes. People often like to keep track of their finances and providing a receipt is a good way for them to keep a record of where their money went.

For organizations, providing donation receipts is part of good donor stewardship. It’s a way to let donors know that their contributions have been received and are greatly appreciated. Most donors expect to receive a receipt upon making a donation, so having to ask for one is an inconvenience that can sour their relationship with your organization.

On the other hand, because receipts are typically sent with a thank-you letter or a note, they act as an opportunity to express gratitude and deepen relationships with donors.

Having a proper receipting system in place is also a sign of good accounting and record keeping. It allows your organization to keep track of all donations coming in.

Plus, if a donor ever asks for a second receipt because they’ve misplaced the first one (this happened quite often at the nonprofits where I worked), you’ll be able to quickly and easily issue them one.

Finally, having a robust receipting system in place can act as an incentive for donors. For some major gift donors, reducing the amount of taxes they have to pay is one of their main reasons for giving, so fundraising officers will often emphasize receipts when making the ask.

Similarly, including a statement about receipts in your year-end giving campaign, for example, reminds people that if they make their donations before the end of the calendar year, they’ll be able to include them when filing their taxes in a few months.

When are Donation Receipts Necessary?

As a general rule of thumb, donors cannot claim a tax deduction without some sort of record that a donation was made. For gifts below $250, this can be a written communication from the organization, such as a thank-you letter or an email. For gifts of $250 or more, an official receipt is required.

That being said, donors will likely ask for official receipts even for gifts under $250, so it is best practice to always include them, regardless of the donation amount. Most organizations set their own threshold simply to be able to better manage their workload. For example, they’ll only issue receipts for donations of $20 or more. When going this route, make sure this is stated clearly wherever you ask for donations so that donors know what to expect.

Even for donations that don’t reach this threshold, be sure to send some sort of written acknowledgement that includes the donor’s name, gift amount and gift date — for example, an automated email that’s sent as soon as the donor completes the form on your donation page and the payment is processed. This way, if the donor chooses to claim a tax deduction with this gift, they still can.

Read More: 6 Steps to Create a Donation Website for Your Nonprofit + 10 Great Examples

Are receipts necessary for in-kind donations?

Yes. In-kind donations should be treated similarly to monetary donations and a receipt should be issued. The only difference is that the receipt won’t include a gift amount, but will instead include a description of the goods or services donated. It is then up to the donor to assign a monetary value to the donation based on what they think the goods or services are worth.

What about partial donations and membership dues?

If a donor receives goods, services or benefits in exchange for their contribution, under some circumstances it can be considered part payment and part charitable donation. In this case, only the charitable donation portion is tax deductible.

For example, if a member pays $100 as their annual member fee and receives $40 worth of member benefits, they can claim $63 as a tax deductible donation.

With payments like membership dues, admission to charity events, contributions in exchange for goods or services, the organization must issue a receipt that clearly states the breakdown of what is considered a payment (according to the fair market value of what the donor is receiving) and what is considered a tax deductible charitable donation.

This document from the IRS (updated annually) has more details on this, as well as exceptions and special circumstances.

How to Write a Donation Receipt

It’s a good idea to set up and follow a standard template when issuing receipts. This not only ensures that you never miss any important information (more on this in the next section), but also contributes to a better donor experience.

Sending donation receipts is part of good donor stewardship, so they should never be sent on their own. Whether you’re sending a physical copy or a digital one, always include a thank-you message along with it — this makes the purpose of your message less transactional.

Printed receipts are typically attached at the bottom of thank-you letters as a tear-off section. Even in situations where you’re not sending a thank-you letter (maybe the donor has misplaced the original receipt and is asking for a second copy), include a handwritten note or card along with the receipt.

On that note, always create a unique ID number for each receipt and save copies of the receipts you issue. This makes them easier to find when donors ask for another copy.

Finally, you have a few options of when exactly to send donation receipts.

For one-off gifts: it’s usually a good idea to send a receipt as soon as possible, within 24-48 hours of the gift.

For recurring donations: a consolidated receipt can be sent at the end of the year (typically no later than January 31 so they have everything they need to start filing their taxes).

Donors may have different preferences about whether they would like individual or consolidated receipts, so be sure to let them choose the option that best suits their needs.

What Needs to be Included in a Donation Receipt?

Although there is no standard format for donation receipts, below are the required elements your receipts should have, according to the IRS:

- Name of the organization

- Name of the donor

- Date of the donation

- Amount of cash contribution

- Description (but not value) of non-cash contribution (if applicable)

- Statement that no goods or services were provided by the organization, if that is the case

- Description and good faith estimate of the value of goods or services that organization provided in return for the contribution (if applicable)

- Statement that the goods or services that the organization provided in return for the contribution consisted entirely of intangible religious benefits (if applicable)

- The organization’s EIN (Employer Identification Number), identifying the organization as tax-exempt by the IRS under Section 501(c)(3)

A Simple Donation Receipt Template for Every Organization

If you’re not sure where to start with your donation receipts, feel free to download and customize this simple template:

How to Set Up Donation Receipts in WildApricot

Although customizing and sending receipts manually will work for a while, it can become time-consuming and tedious if you have a lot of donations coming in. Not to mention, there’s lots of room for human error.

If you want an easier solution, you can set up automatic donation receipts with WildApricot. This way, your receipts will be generated, sent and stored automatically when someone makes a donation through your donation form.

Here’s how to set this up.

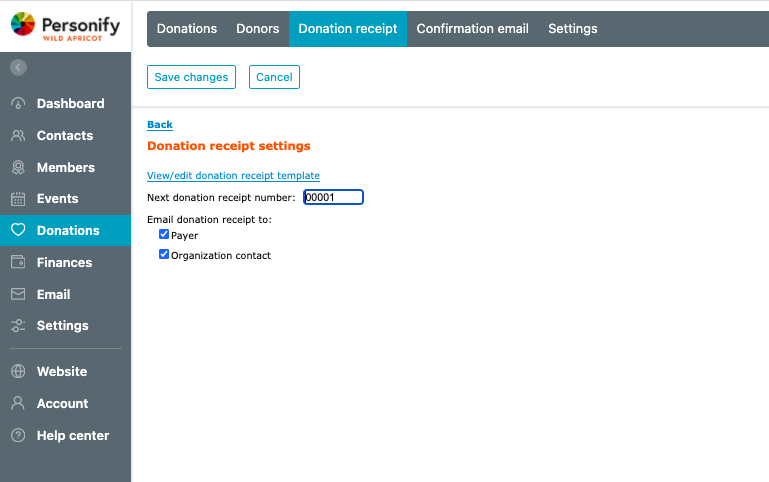

In your WildApricot dashboard, hover over the Donations menu then click Donation receipt.

Here you’ll be able to control who receives the donation receipt email and set the next donation receipt number. The donation receipt number is automatically incremented each time a new donation is completed, and can be up to 7 digits in length.

(Note: You can set the next donation receipt number to be used, but if you enter a number that is already in use, multiple donation receipts may end up with the same number.)

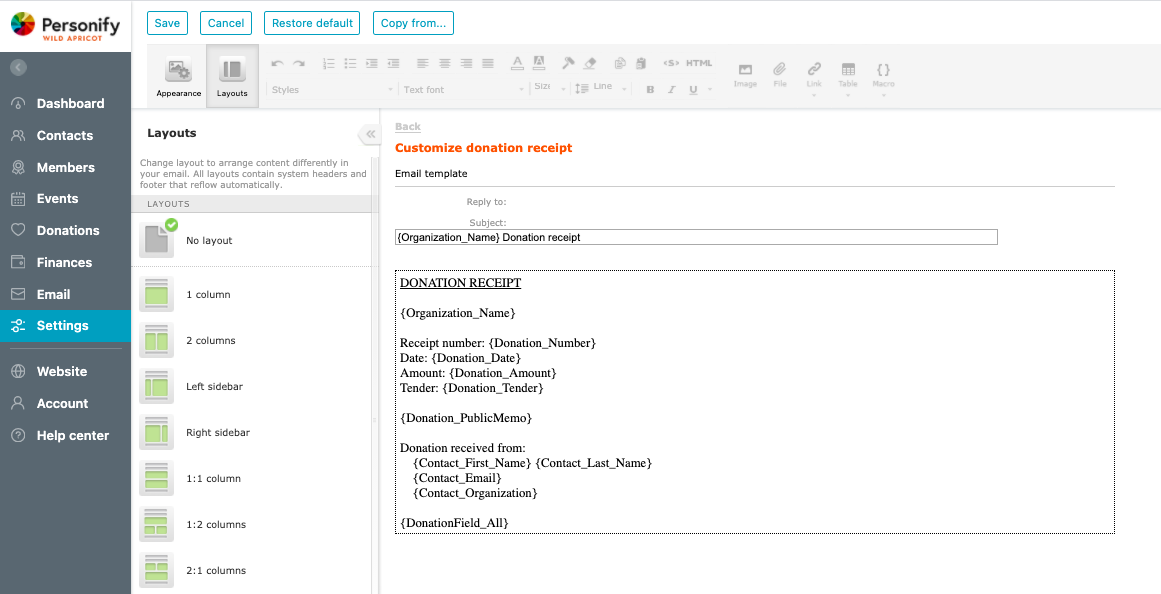

To modify your receipt template, click View/edit donation receipt template. Then, click the Edit button to begin customizing the template.

Here you’ll be able to adjust the layout of your receipts and customize the template by adding or removing text, graphics, and macros.

To choose a previous email or an email template as the basis for the email, click the Copy from button. To restore the original pre-modified version of the email – the factory default – click the Restore default button.

Click the Save button. You can then preview what your receipt will look like by clicking the Send test email button to receive a sample donation receipt email.

And that’s it! Your donors will now receive an automatic donation receipt in their email inbox as soon as they make a donation.

If you don’t yet use WildApricot, sign up for a free 60-day trial now and see for yourself how much time it can save you by processing donations and automating so many more of your administrative tasks.

You’re All Set!

You’re now ready to start collecting donations and issuing donation receipts. The IRS rules can be a little complicated, so I recommend that you familiarize yourself with what’s applicable to your specific type or organization and fundraising activity.

Just remember that at the end of the day, it is the donor’s responsibility to make sure their donation is tax deductible and to obtain the necessary documentation. However, your organization is expected to meet the donor halfway and make this process as easy for them as possible.

If there’s anything you’re uncertain about, just don’t make any definitive statements (for example, say “this donation may be tax-deductible”, instead of “this donation is tax deductible”) and provide as many disclaimers as you deem necessary.

Happy fundraising and receipt issuing!